Cargando

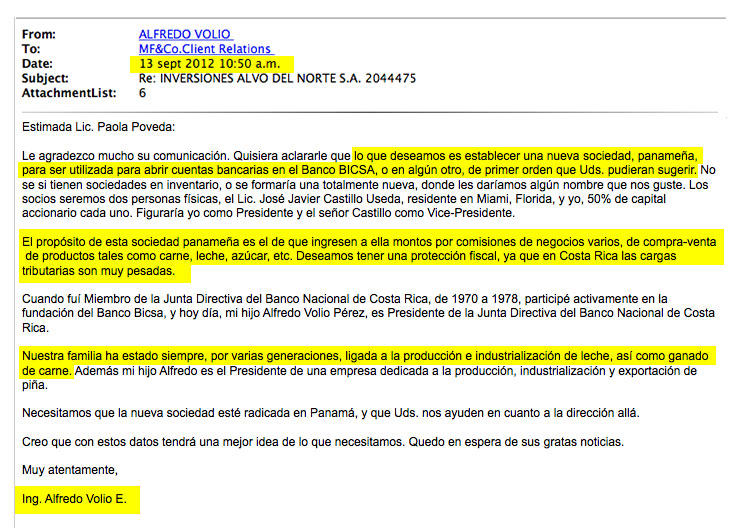

“We would like to have tax protection, because tax burdens are too heavy in Costa Rica.” This is the express wish of engineer Alfredo Volio Escalante, businessman and member of a Costa Rican family linked for generations to milk and beef production and industrialization, in an email sent to the law firm Mossack Fonseca & Co, based in Panama and with offices worldwide, on September 13, 2012.

Volio Escalante sought to establish a corporation in Panama to open bank accounts in the local branch of BICSA, a bank which he co-founded. These accounts, he wrote, would be used to receive “miscellaneous business commissions, money from the purchase and sale of products, such as meat, milk, sugar, etc.”

The incorporation of the company, Inversiones Alvo del Norte S.A. -through Mossack Fonseca-, never materialized.

This communication is part of the secret files obtained by the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists (ICIJ) DataBaseAR - the research unit at AmeliaRueda.com - and more than 100 media partners around the world, in the largest global investigation in history.

The more than 11 million documents, dating from 1977 to December 2015, show the inner workings of Mossack Fonseca, a global law firm based in Panama with offices around the world, specialized in creating offshore shelters for its customers. They provide facts and figures — cash transfers, incorporation dates, links between companies and individuals — that illuminate a dark alternate universe where some people go to play by different rules; the universe of a firm that enables such behavior.

DataBaseAR contacted Volio Escalante, a member of the Board of Banco Nacional de Costa Rica from 1970 to 1978, at the same email address he used to communicate with Mossack Fonseca and on one of the phone numbers he provided the Panamanian firm.

“None of that was ever carried out,” said Volio Escalante, 79 years old, over the phone. “I’m retired, sick; I’m not interested,” he replied when asked for a personal interview.

His lawyer, Jorge Ortiz, called Volio Escalante’s email message “a mere communication,” and said his client has no offshore companies.

Neither Ortiz nor Escalante Volio denied the veracity of the email.

Though not connected to Volio Escalante, Marcos Dueñas Leiva, President of Intaco, had taken the same road as the farmer-businessman a year before. Marcos Dueñas is brother to the Minister of Foreign Trade (2000-2002), ambassador of Costa Rica in Washington (2004-2009) and ambassador in Brussels (2010-2013), Tomás Dueñas.

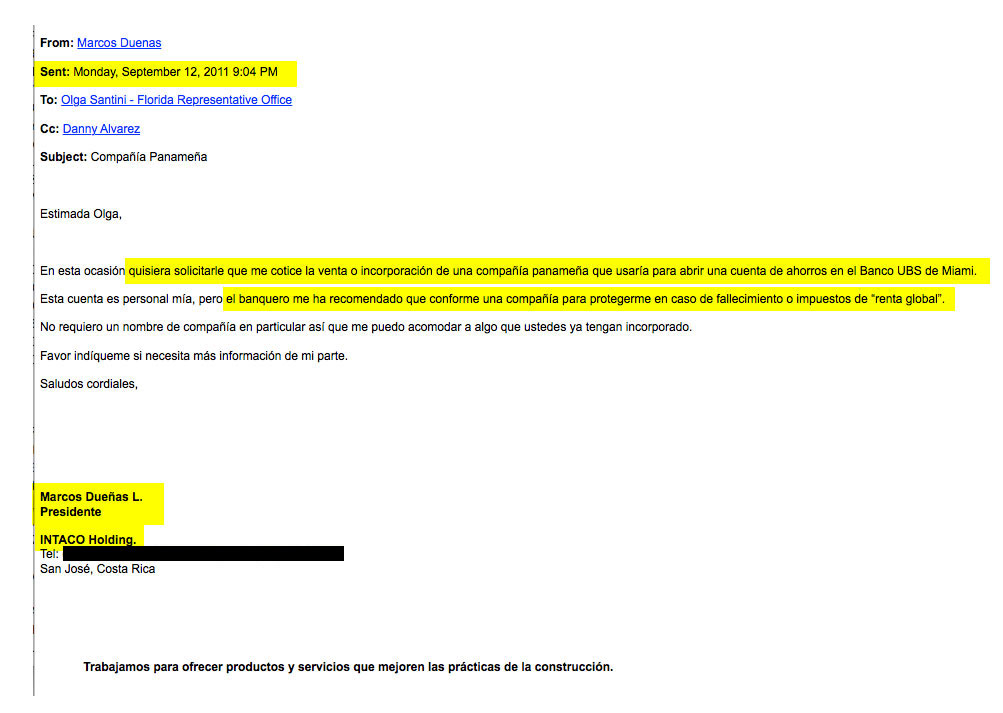

“The banker has advised me to establish a company to protect me in case of death or taxes from ‘global income’,” wrote Marcos Dueñas in an email sent on September 12, 2011 to Mossack Fonseca’s representative of corporate services in Florida, USA, Olga Santini.

That year, the Laura Chinchilla administration (2010-2014) presented a bill of law on tax solidarity to the Legislative Assembly.

The purpose of the corporation would be to control Dueñas’ savings account at UBS bank in Miami.

“I do not need a company name in particular, so I can settle for anything you already have incorporated,” says Duenas in the email.

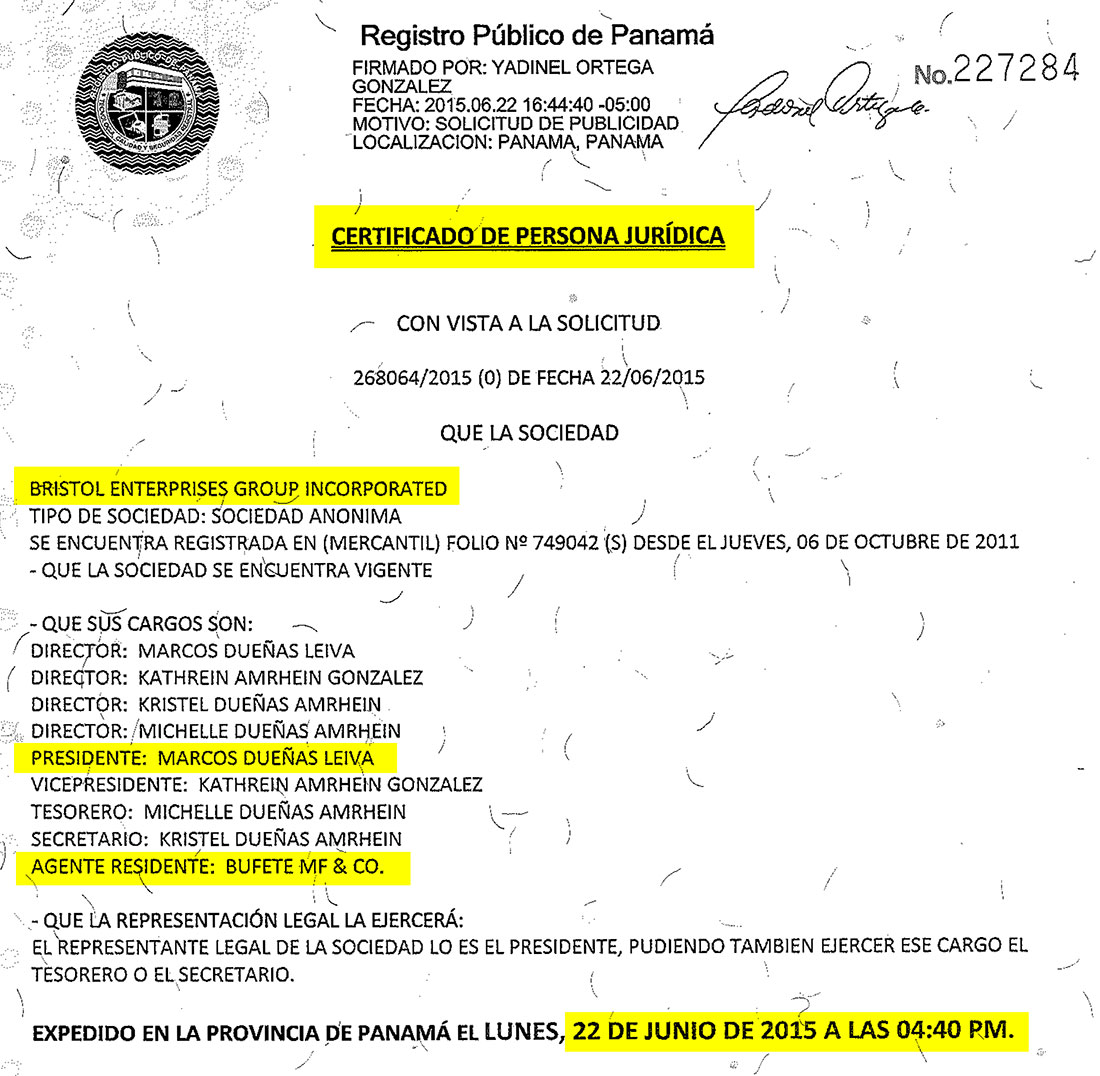

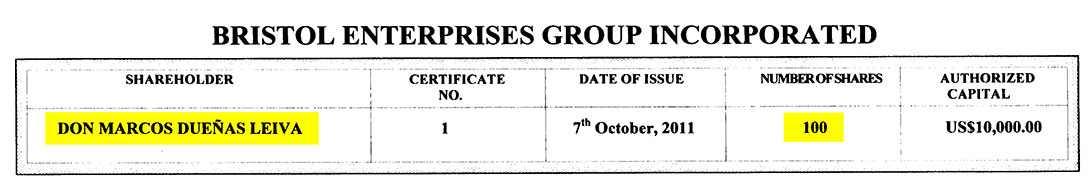

This request led to the incorporation of a new company, Bristol Enterprises Group Incorporated, domiciled in Panama and included since October 6, 2011 in that country’s Public Registry, with Mossack Fonseca as registered agent.

Update 04.06.16, 2 p.m. Bristol Enterprises Group Inc. is related to Mossack Fonseca’s client 29030: Intaco International Holding Ltd. According to the files, this link began on May 24, 2010 and was still current in late 2015.

The leaked documents show that shares of Bristol Enterprises Group Inc were issued in the name of Marcos Dueñas; as directors of the corporation, Intaco’s president appointed his wife Kathrein Amrhein Gonzalez vice-president and his daughters Kristel and Michelle, secretary and treasurer, respectively.

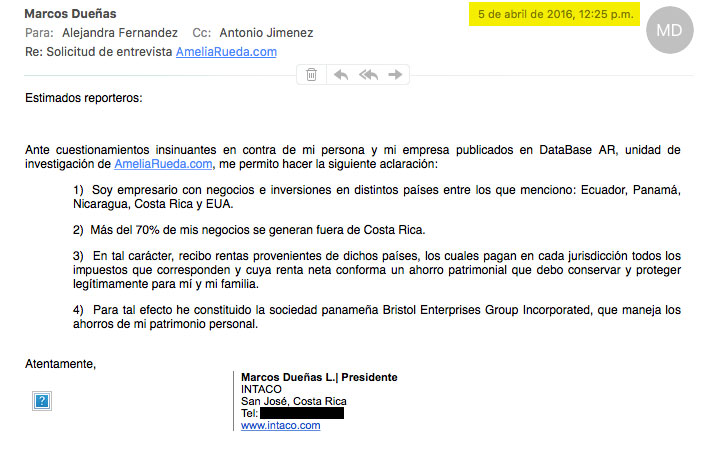

Marcos Dueñas, 64 years old, answered the request for comment sent by DataBaseAR on Tuesday, April 5. He did so 3 hours and 25 minutes after the publication of this news story, although he was offered an opportunity to comment since March 22. He replied from the same email address used to send the email to Mossack Fonseca. This is his answer:

These were DataBaseAR’s questions:

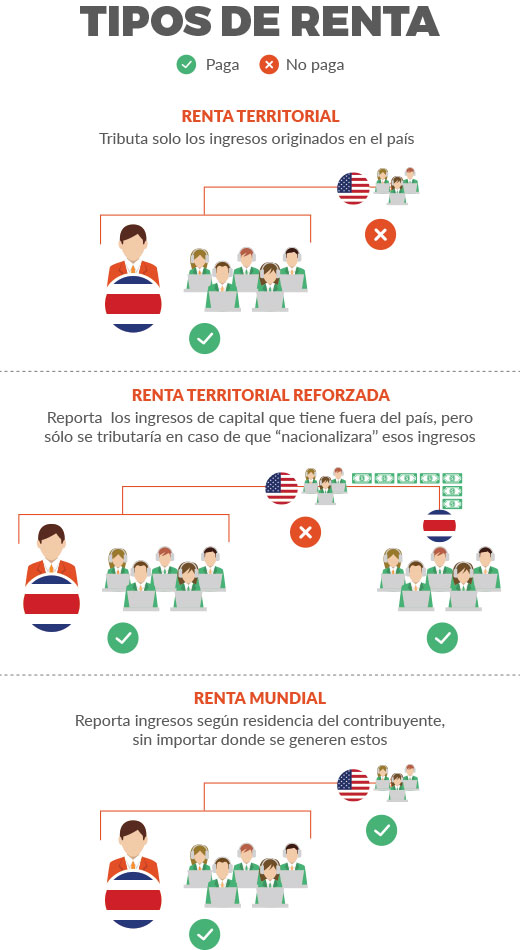

For the past 15 years, Costa Rica has discussed, unsuccessfully, the possibility of reforming its tax model, which is governed by the principle of territoriality. This means that income tax only applies to income generated by taxpayers - whether nationals or residents - in Costa Rica.

A first attempt to change the model was fostered by the Abel Pacheco administration (2002-2006), with the bill for a “Law on Fiscal Covenants and Structural Fiscal Reform.” This initiative proposed, among other changes, a global income model, i.e., adding into a single tax base all earnings and occupational and capital income.

The bill failed on March 22, 2006, when the Constitutional Chamber declared the procedure followed by congresspeople in the Legislative Assembly to approve this tax bill in the first debate unconstitutional.

Laura Chinchilla’s administration (2010-2014) chose a different course and promoted the bill for the Law on Tax Solidarity in January 2011, which meant a shift towards enhanced territorial income taxes, considered even by current Treasury authorities the most appropriate for countries receiving investment, such as Costa Rica.

The change would have required a Costa Rican national or resident to report to tax authorities capital inflows they have outside the country, only applying income taxes if such revenues were “nationalized” or, put another way, repatriated.

Under this scheme, for example, a Costa Rican living in the United States and investing in shares of a company in that country would only pay income taxes if he ever decided to sell the shares or transfer the profits to Costa Rica. While the capital is abroad, it is reported to the tax authorities, but it only pays taxes if it is repatriated.

Procedural errors in the Legislative Assembly, pointed out by the Constitutional Chamber on March 14, 2012, sent Chinchilla’s initiative toppling down.

The notion of enhanced territorial income is now being recaptured by the government of Luis Guillermo Solís Rivera in the bill for an Income Tax Law under file 19679 in the Legislative Assembly.

“It is a first step towards worldwide income,” director general of the General Directorate of Finance, Priscilla Piedra, told DataBaseAR. “It would allow taxing passive income, foreign investments, when returning to the country,” she said.