Cargando

At 1:24 p.m. on Saturday, September 26, 1998, an email from Mossack Fonseca & Co, a Panama-based law firm, to its branch in Tortola - the largest and most populated of the British Virgin Islands -, outlined the plan to follow so that the now extinct Costa Rican company Borda Azul S.A. - then chaired by Hermes Navarro Vargas, who led the Costa Rican Football Federation from 1999 to 2006-, could trick national tax authorities.

This was revealed in secret files obtained by the German newspaper Süddeutsche Zeitung, and shared with the International Consortium of Investigative Journalists (ICIJ), DataBaseAR - the research unit at AmeliaRueda.com - and more than 100 media partners around the world.

The more than 11 million documents, dating from 1977 to December 2015, show the inner workings of Mossack Fonseca, a global law firm based in Panama with offices around the world, specialized in creating offshore shelters for its customers. They provide facts and figures — cash transfers, incorporation dates, links between companies and individuals — that illuminate a dark alternate universe where some people go to play by different rules, and of a firm that enables such behavior.

Such is the case of the company owned by Navarro Vargas, now 67, and his partner, Cuban-American Ten Brink, who was vice-president of the company.

In 1998, choked by multiple investigations by the Ministry of Finance, the Ministry of Foreign Trade (COMEX) and the Public Prosecutor of Costa Rica, Borda Azul, also known as Tunacan and whose specific activity was processing tuna for export, hired the Panamanian law firm.

Ten Brink handled the details. On Friday, September 25, 1998 he traveled from Costa Rica to Panama to meet with Mossack Fonseca attorney, Ramsés Owens, the following day.

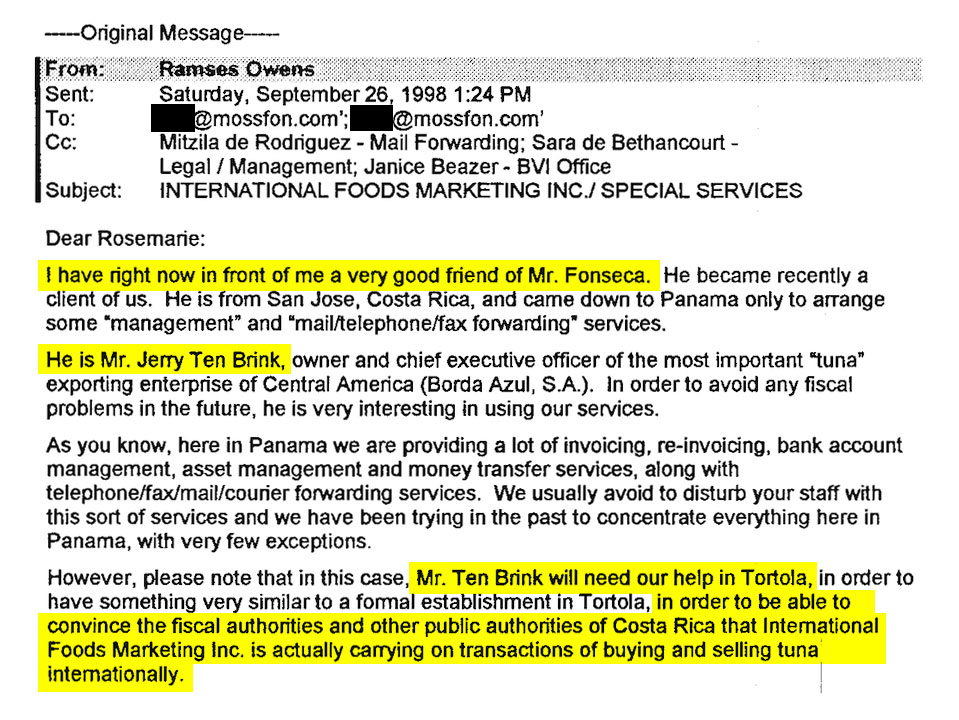

“I have right now in front of me a very good friend of Mr. Fonseca,” reads the opening sentence of an 825-word email written by Owens in English, which provides Mossack Fonseca's office in the British Virgin Islands instructions on the work to perform for the Costa Rican clients.

Mr. Fonseca is Ramón Fonseca, founding partner of Mossack Fonseca & Co., who is mentioned at the beginning and the end of the email.

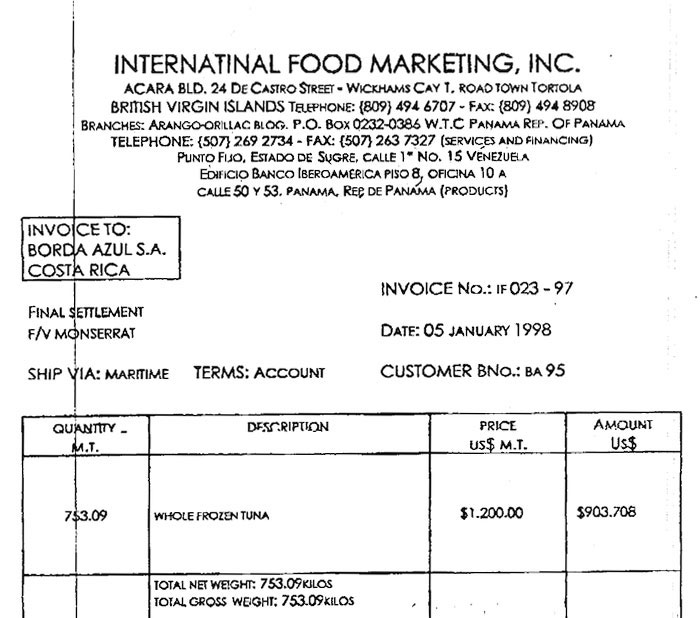

“He is Mr. Jerry Ten Brink, owner and chief executive officer of the most important “tuna” exporting enterprise of Central America (Borda Azul, S.A.),” Owen goes on. “Mr. Ten Brink will need our help in Tortola in order to be able to convince the fiscal authorities of Costa Rica Foods that International Foods Marketing Inc. is actually carrying on transactions of buying and selling tuna internationally.”

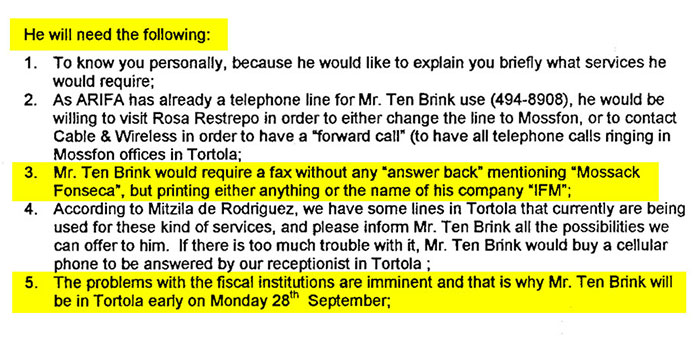

To this end, the files reveal, Borda Azul hired fax services in the British Virgin Islands (BVI). Upon receiving documents from Costa Rica, they were to respond with the acronym IFM, for International Food Marketing Inc., the offshore company Navarro and Ten Brink, legal representatives of the tuna exporter, submitted to national authorities as raw material provider, when in fact it was a shell company.

Additionally, they also requested a BVI telephone line which would be operated, for six months, by a person specially instructed to answer, in English, “Hello, International Food Marketing, how can I help you?” Any queries should be forwarded to a phone number in Panama, answered by a Mossack Fonseca lawyer.

Meanwhile, in Panama the firm would provide billing and chargeback services, and it was also resident agent of IFM in the BVI, replacing the firm Arias Fábrega & Fábrega.

“Mr. Fonseca would like to help Ten Brink as much as possible, which is why we send this urgent message,” the email concludes.

Two days later, Rosemarie Flax, executive director of Mossack Fonseca & Co. in the British Virgin Islands, welcomed the Cuban-American with business interests in Costa Rica to Tortola.

When asked by DataBaseAR, Ten Brink, now 73 years old, denied knowing the Panama-based firm; he also said he did not know Ramón Fonseca or Ramsés Owens.

As for International Food Marketing Inc., the businessman said he did not remember anything. Referring to Borda Azul S.A., he stated: “That company disappeared so many years ago; I do not remember any of this.”

What he did remember, was that “in some areas,” without specifying which, Costa Rican lawyers, Gonzalo Fajardo Salas and Juan Diego Castro, had been his attorneys.

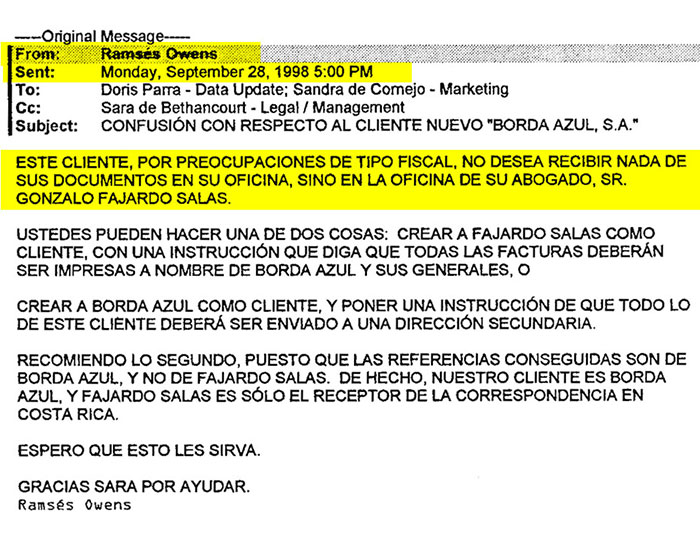

Invoices issued by Mossack Fonseca as proof of the services provided to Borda Azul were billed to attorney Fajardo Salas. DataBaseAR contacted Fajardo Salas for comments on this link to Mossack Fonseca, but relatives explained he could not provide any statements due to a stroke suffered in 2015.

Navarro and Ten Brink were defended by Castro in a court case in Costa Rica.

Juan Diego Castro, through his press officer, denied any and all connections to the Panamanian law firm. Moreover, he said he has no relationship with, nor information on, other domestic or foreign companies linked to Navarro and Ten Brink.

Vargas Navarro's wife, Claudia Zúñiga, said that the former football executive, now 67 years old, was experiencing health problems -liver and spinal complications- and, therefore, was in no condition to provide interviews.

Three facts surround Borda Azul S.A. representatives’ contact with Mossack Fonseca & Co.: an investigation by the Ministry of Finance and another by Comex, both launched in 1998, and a criminal complaint against Navarro and Ten Brink for fraud, which dates back to 1997.

On September 16, 1998, the General Directorate of Finance asked the Costa Rican tuna company for proof of purchases of raw materials in order to verify its exports in the fiscal years of 1996, 1997, and 1998.

The Ministry of Finance sought to determine whether the company should continue enjoying the benefit of Tax Credit Certificates (CAT), which were under scrutiny since 1994, when the first misuses of these tax incentives were detected at other companies.

Under export contract No. 152 - in force between February 19, 1986 and the fiscal closing of 1999 - Borda Azul sold shrimp, lobster, crustaceans, mollusks, fish and tuna to third markets in North America and Europe, among others, and qualified for the CAT. It was one of the 10 companies that recorded the largest amounts received on account of this tax incentive in the nineties.

Data from the Central Bank of Costa Rica (BCCR) specify that, between 1991 and 1998, the Bank issued a total of around ¢2.6 billion in CATs on behalf of Borda Azul S.A. Of this amount, 83% corresponds precisely to CATs of the three-year period - 1996, 1997 and 1998 - investigated by the Ministry of Finance.

Along with the investigation by the Ministry of Finance, on September 30, 1998, Costa Rica's Office for the Promotion of Foreign Trade, upon request of Comex, instructed Borda Azul, via official letter G.O.-5202-98, to provide trade documents supporting their local purchases of goods and services in order to calculate the company's percentage of National Value Added, which should no be less than 35% under CATs.

Documentation presented by the tuna exporter, according to Comex records, pointed to International Food Marketing Inc. as the supplier of 31% of tuna purchased as raw material for fiscal year 1997 (October 1, 1996 to September 30, 1997) in the amount of approximately ¢1.6 billion.

Doubtful of the bills, and estimating that the National Value Added was only 2.98% for whole tuna, Comex initiated an administrative procedure on February 4, 1999 in order to determine the role of Borda Azul in the alleged infringements.

Meanwhile, Public Prosecutors accused Navarro and Ten Brink before the Criminal Court of San José's First Judicial Circuit of fraud against the BCCR and the Ministry of Finance based on an anonymous complaint of April 8, 1997.

The anonymous report argued that, in order to receive $3 million in tax incentives from the Central Bank in 1996, Borda Azul should have recorded tuna exports above $20 million, equivalent to 14 thousand tons of raw material. However, the anonymous accusation stated they had barely unloaded 4 thousand metric tons of raw material in national ports.

On October 30, 1998, Navarro Vargas and Ten Brink notified the President of the Republic, Miguel Angel Rodríguez, Finance Minister Leonel Baruch, the Minister of Economy and Foreign Trade, Samuel Guzowski, and the President of the Central Bank, Eduardo Lizano Fait, the sale of Borda Azul S.A.'s processing plant in La Ribera, Belén to Aquastar S.A. -of Ecuadorian capital- alleging that its financial situation had worsened due to the multiple investigations they had been subjected to, which closed their doors to credit.

Aquastar, which processed the tuna brand Splash, closed operations in Costa Rica in March, 2000, with debts over $10 million to its creditors.

Now, seventeen years later, Mossack Fonseca & Co.'s secret files contain evidence as to how Borda Azul misled not only the tax office but also Comex and judicial authorities.

International Food Marketing Inc., as the leaked documents show, was controlled by Borda Azul and domiciled in the British Virgin Islands. What existed between them was a false contract.

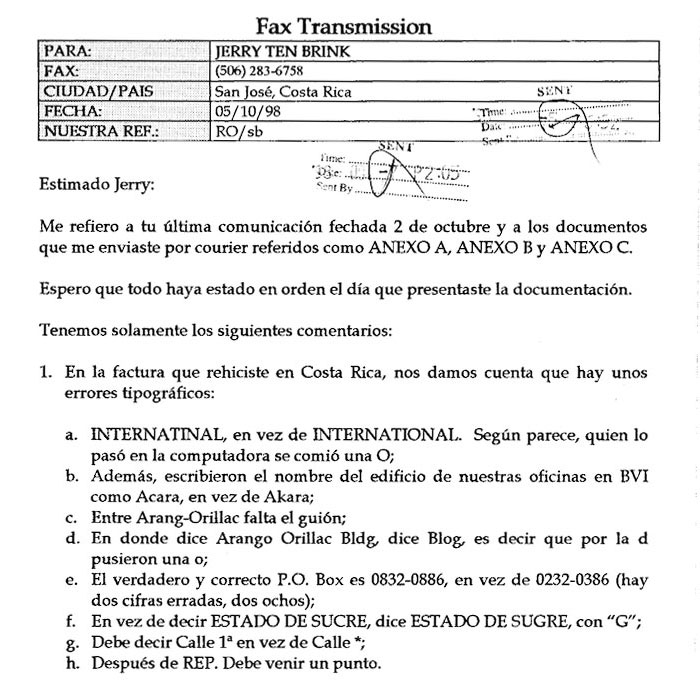

“Authorities have already asked me -informally- to give them the “corporate ID” of International Food Marketing (IFM),” wrote Borda Azul co-owner, Ten Brink, in a fax sent on October 8, 1998 to Mossack Fonseca attorney, Ramsés Owens. “It is possible that, if they are asking me for IFM's corporate ID, they will call the phone numbers on the company stationery, so we must be ready for that,” he added.

As additional support, Ten Brink requested Mossack Fonseca's office in the British Virgin Islands to send a note to Costa Rican tax authorities, using a “crude” tone, stating that the company was established in 1988.

“I do not have the deed here, but I think that is the date of constitution,” wrote Ten Brink. As per his instructions, the note should also explain that IFM has “trading and finance operations in many parts of the world, and has operated with Borda Azul S.A. since November 1995.”

After receiving the fax, Owens alerted Mossack Fonseca's BVI office that they might receive a call from Costa Rican tax authorities. Owens reminded the office that, if that were to happen, they had to make the authorities believe that International Food Marketing Inc. was actually a large company selling tuna to Borda Azul and many other companies in Central America.

For fiscal year 1998, Borda Azul submitted at least 22 invoices to the Ministry of Finance for alleged purchases of frozen tuna from International Food Marketing Inc., amounting to $16 million. Four of the bills include contradictions between the total net weight and the metric tons reported.

“The (silly) mistakes we made were only on one invoice, which we did not correct. I believe the rest were perfect,” said Ten Brink in a fax sent on October 8, 1998 to Panama.

In a memo to the two founding partners of Mossack Fonseca, Jürgen Mossack and Ramón Fonseca, on October 19, 1998, Owens admits that “it is clear that our client avoids paying taxes and, at the same time, gets 10% - 15% in CATs, issuing chargebacks to International Foods Marketing.”

Despite this, he advises his seniors to continue providing chargeback services to Borda Azul “because 95% of our work, coincidentally, consists of selling vehicles to avoid paying taxes.”

In a written response to requests by the International Consortium of Investigative Journalists and their media partners, the Panamanian firm said it “strongly disagreed with any statement that implies that the main function of the services we provide is to facilitate tax avoidance and/or evasion. “

Almost prophetically, Mossack Fonseca's lawyer, Owens, who founded his own firm, Owens & Watson, mocks the Costa Rican judicial system in the 1998 memo.

“Worst-case scenario, being very bleak, the government of Costa Rica could, after years of investigations, suspend the issuance of CATs to Borda Azul, on account of irregularities, but they would never send anyone to jail.”

The Criminal Court of the First Judicial Circuit of San José, on March 3, 1999, definitely acquitted Navarro and Ten Brink's case of fraud against the BCCR. Juan Diego Castro acted a defense attorney for the defendants in this case.

“All documentary evidence from that litigation was returned to the customers over 15 years ago,” said Castro in response to questions from DataBase-AmeliaRueda.com. He added that, due to the legal and ethical restrictions of the practice of the law, he could not disclose any details, evidence or particular aspects of the case without permission of his clients in that process.

Fundamental to the acquittal of the case was report No. 234-C103-98 of the Section of Accounting Research of the Judicial Investigations Unit (OIJ), which concluded, on September 18, 1998 that Borda Azul had actually bought 14,000 tons of tuna, and not just 4,000 tons. Therefore, it had indeed exported over $20 million in the fiscal term of 1995-1996, contrary to the allegations of an anonymous complaint.

To reach that conclusion, the OIJ analyzed documents provided by the tuna exporter, which accounted for the purchase of 13,083,505 kilograms of tuna, mostly from International Food Marketing Inc.

On February 18, 2003, four years after initiating an administrative proceeding against Borda Azul, the Ministry of Foreign Trade absolved the company of any responsibility for the charges against it and removed the suspension of CATs.

As part of the evidence, they cited the report by the OIJ, the same that tipped the scales in favor of an acquittal of Navarro Vargas and Ten Brink for the case of fraud against the Central Bank of Costa Rica and the Ministry of Finance.

The data and details exposed by the secret files 17 years later remained unknown to the authorities.

Although the statute of limitations for the action has elapsed, this case can be used to review forensic audit procedures - which examine financial and accounting evidence to determine the presence of administrative, criminal or civil offences - in the country, according to criminal lawyer Ewald Acuna.

“Documentary evidence for local authorities cannot be based solely on the documents provided by persons under investigation. It is necessary to confirm the veracity of the information,” said Acuña.